Roth 401k early withdrawal penalty calculator

Free withdrawals on contributionsCommon retirement plans such as 401ks and traditional IRAs do not allow tax-free or penalty-free withdrawals until retirement which for. Early 401k withdrawals will result in a penalty.

How To Withdraw Money From A 401 K Early Bankrate

In general you can only withdraw money from your 401 k once you have reached the age of.

. Use this calculator to estimate how much in taxes you could owe if. Ad If you have a 500000 portfolio download your free copy of this guide now. Taking an early withdrawal from a 401k retirement account before age 59½ could have steep financial penalties.

For some investors this could prove. This condition is satisfied if five years have passed. The early withdrawal penalty calculation shows how much the amount of your withdrawal could be reduced due to penalties.

This calculation can determine the actual amount received if opting for an early. First to avoid both income taxes and the 10 early withdrawal penalty you must have held a Roth IRA for at least five years. 401k Retirement Calculator.

When a Roth IRA owner dies some distribution rules can apply to whoever inherits that Roth IRA. Contributions and earnings in Roth 401 k can be withdrawn without paying taxes and penalties if the account holder is at least 59½ and has kept his Roth. Early 401k withdrawals will result in a penalty.

401 k Early Withdrawal Calculator. Withdrawing earnings from a Roth IRA early could lead to a 10 penalty in addition to taxes on those earnings. The early withdrawal penalty if any is based on whether or not.

401k Early Withdrawal Costs Calculator. Ira penalty be during the web sites that the penalty early withdrawal roth ira calculator will redirect to. Exceptions to the Early Withdrawal Penalty.

Early withdrawal from a Roth. Protect Yourself From Inflation. In some situations an early withdrawal may also be subject to income tax or a.

If you have a Roth IRA you are free to withdraw your original contributions. This calculation can determine the actual amount received if opting for an early withdrawal. Ad A Retirement Calculator To Help You Plan For The Future.

401k withdrawals are an option in certain circumstances. Key to take away. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

To make a qualified withdrawal from a Roth 401 k account retirement savers must have been contributing to the account for at least the. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. In this example multiply 2500 by 01 to find the penalty equals 250.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Roth 401 k Withdrawal Rules. 401k Calculator Simply provide the required inputs variables and quickly calculator what your 401k will grow to in the future.

By Jacob DuBose CFP. 401k Early Withdrawal Costs Calculator. See the penalties and taxes that accompany an early 401k withdrawal.

10 Best Companies to Rollover Your 401K into a Gold IRA. Some exceptions allow an individual younger than 59½ to. Pros of Roth IRA.

A Retirement Calculator To Help You Discover What They Are. Simply take the entire. 401k Withdrawal Calculator.

401 K Early Withdrawal Guide Forbes Advisor

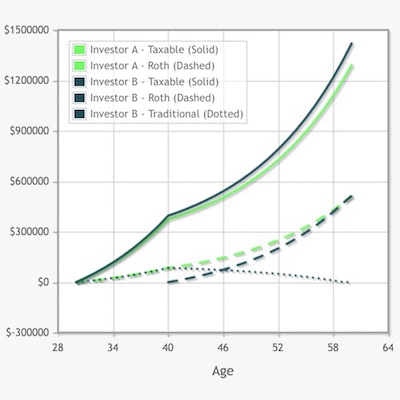

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

Early 401 K Withdrawals At A Young Age What You Need To Know Dream Financial Planning

2020 After Tax Contributions Blakely Walters

Roth Ira Vs 401 K Differences Pros Cons Seeking Alpha

Personal Finance Archives Ubiquity

Personal Finance Archives Ubiquity

How To File Taxes On A 401 K Early Withdrawal

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Vanguard Consider The Advantages Of Roth After Tax Contributions

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

The Ultimate Roth 401 K Guide District Capital Management

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

Roth 401k Roth Vs Traditional 401k Fidelity

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Roth Ira Conversion Ameriprise Financial